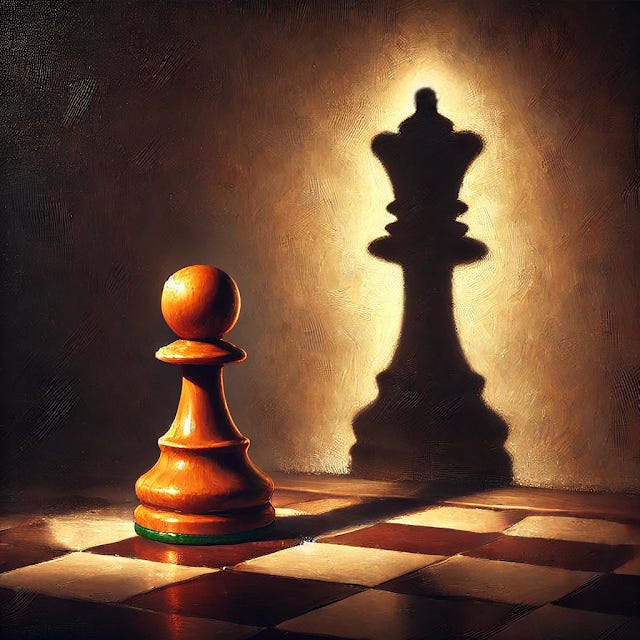

Narrow Leverage: How Small Strengths Create Big Power

If you have uniquely powerful but “narrow” leverage in a given domain, you can amplify and transfer it asymmetrically to gain influence beyond your initial constraints.

Example 1: Paul Atreides playing up religious zeal → Galactic emperor

Paul Atreides began with narrow leverage: the Bene Gesserit-implanted prophecy among the Fremen, a small but elite fighting force, and control over Arrakis’ spice trade. Despite being technologically and numerically outgunned, he used these assets to:

Exploit the Lisan al-Gaib myth to unify and control the Fremen.

Turn Fremen fanaticism into a powerful political and military force.

Leverage the galaxy’s spice dependency to bring the Empire to its knees.

Example 2: Trump running a popular TV show → President of the United States

Trump didn’t follow a conventional political path—he transferred his media leverage into political power:

Real estate mogul → Built financial capital and name recognition.

Reality TV host → Used mass-market media presence to cultivate nationwide appeal.

Presidential campaign → Transformed celebrity status into political dominance.

Example 3: Carl Icahn’s minority stake & fear campaigns → De facto control over huge companies

Carl Icahn controlled companies without owning them by leveraging minority stakes and fear of his influence:

TWA (1985) – Used borrowed money to buy TWA, then sold off assets for profit while leaving the company in debt.

Apple (2013-2016) – Took a $3.6B stake and pressured Apple into massive stock buybacks, profiting before exiting.

Netflix (2012) – Invested $321M, pressured Netflix to consider selling, then exited with a $1.6B profit.

Example 4: Napoleon’s artillery expertise → Emperor of France

Napoleon’s narrow technical expertise in artillery became a stepping stone to political and military dominance:

Mastered artillery tactics, using cannons offensively and repositioning them mid-battle.

Toulon (1793) – His artillery strategy drove out the British, earning him his first major promotion.

Italian campaign (1796-1797) – His battlefield success made him the most famous military leader in France.

Political leverage → 18 Brumaire Coup (1799) – His military credibility allowed him to overthrow the government and become First Consul, later Emperor.

Corollaries of narrow leverage

1. “All money is green” → capital transcends its origins

If you have capital, you can deploy it into new arenas. People don’t care where the money came from—only that you have it.

Examples:

François Pinault (wood trading → luxury empire)

Started as a timber trader in France, pivoted into high fashion (Gucci, Balenciaga, YSL) and became a luxury tycoon.

Roman Abramovich (Russian oil → Chelsea FC & global influence)

Used wealth from post-Soviet oil deals to become a global power player, gaining influence in both sports and politics.

2. “Attention is currency” → visibility can be monetized and weaponized

If you control attention, you control perception—perception then dictates reality; fame doesn’t require expertise, it requires narrative control.

Examples:

Kim Kardashian (reality TV → beauty empire → billionaire)

MrBeast (YouTube algorithm mastery → business empire & mainstream deals)

Andrew Tate (kickboxing → controversial internet empire)

Had a mediocre sports career, but transformed himself into an online cult figure through algorithm hacking and controversy.

3. “Control the pipes” → owning infrastructure is the ultimate power

The highest leverage comes from controlling access, not just participating. If people depend on your infrastructure, you have permanent leverage.

Examples:

Bloomberg Terminal (owning market data → financial gatekeeping)

Every major finance firm relies on Bloomberg’s data terminals, making them essential to the financial world.

Epic & Cerner (healthcare data → US medical infrastructure)

Control over medical records means they dictate how hospitals and insurers operate.

Elon Musk (DOGE use of read-only access to government payment flows)

Government agencies often operate with slow-moving bureaucracy; Musk, through read-only access to payment flows, is able to spot underutilized funds or inefficient allocations.

4. “Leverage is a one-way ratchet” → once you have power, it’s easier to get more

Leverage compounds—once you break through, every move gets easier. Gatekeepers apply rules to others, not themselves.

Examples:

Warren Buffett (success in investing → better deal flow → easier future wins)

Reed Hastings (Netflix streaming → dictating Hollywood production)

Started by licensing movies, then moved into content creation, now Hollywood depends on Netflix more than vice versa.

5. “Be the bottleneck” → if everything flows through you, you’re unstoppable

If people can’t bypass you, you own the game.

Examples:

Intel (owning the semiconductor pipeline → Dictating computing power for decades)

OPEC (oil cartel → holding leverage over global energy markets)

Hollywood Agencies (talent pipelines → controlling entertainment industry deals)

GitHub (default for software hosting → indirect control over global development)

6. “Elite buy-in is optional” → mass adoption can rival institutional approval

If enough people back you, institutional opposition becomes irrelevant.

Examples:

Cryptocurrency (ignored by banks → now held in hedge fund portfolios)

TikTok (dismissed as a toy → now a threat to Instagram & YouTube)